I constantly get this question: “I want to make more money. Where do I begin?”

My response usually comes as a surprise.

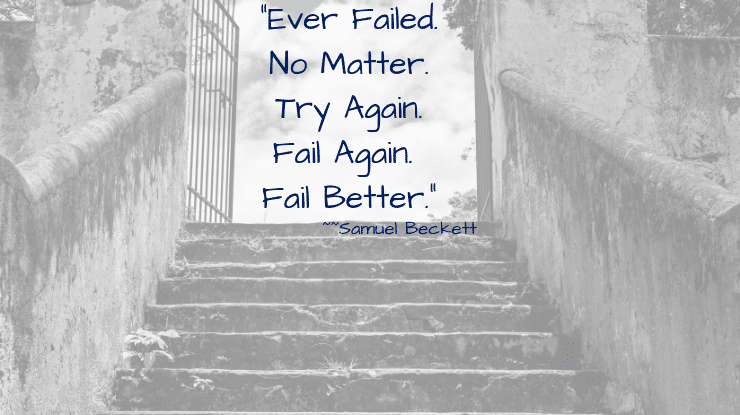

“Begin by admitting what’s not working in your life,” I say. They look puzzled.

“There’s tremendous power in telling the truth,” I explain. “In my interviews with former underearners I noticed that their financial achievement or breakthrough was often preceded by a financial or personal challenge—one they could not ignore.”

Problems have a purpose. They are there to get our attention.

Until you stop denying, or diminishing, your difficulties, you can’t possibly do anything differently.

Your first peek at the truth may evoke temporary panic. But, rest assured, situations can rapidly improve once you take off the blindfold.

Get the support you need to create the Wealth you desire in my virtual community of women supporting women, The Wealth Connection. Now only $47/month! Join the conversation today!

There’s still time to join the Spring 2019 Session of my ReWIRE Mentorship Program!

There’s still time to join the Spring 2019 Session of my ReWIRE Mentorship Program!