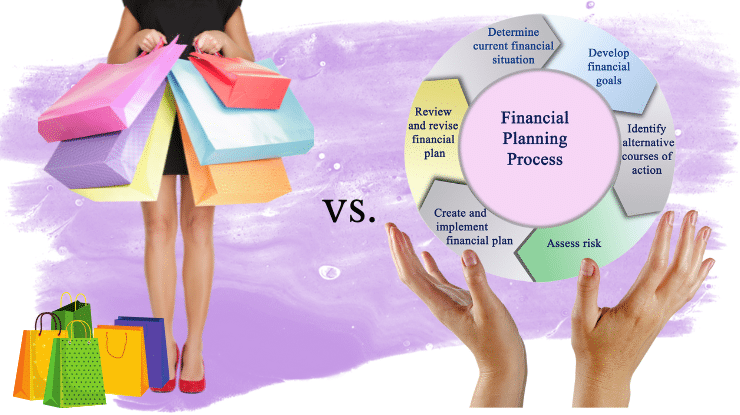

I truly believe the best way for women to create wealth is by working with financial professionals. But, according to the Wall Street Journal, “fewer than one in five women currently has an advisor.”

Why? Because women can’t find anyone who understands them.

Advisors are talking to women just like they do men. Big mistake. True, money knows no gender. Women, however, are very different from men. Yet the financial world is based on the male model of communication.

Last week I offered 2 pointers answering the question: What would you like to tell the financial industry about how, specifically, they can better serve women?

Here are 3 more.