I’ve recently had a number of conversations that centered on 3 questions.

- What is Wealth?

- How do you create Wealth (without becoming a workaholic?)

- Why is creating Wealth so scary?

Today, I’d love to share my responses. Let’s begin with the first. Simply put, Wealth is having more than you need…so money ceases to be a source of stress and becomes a tool for living life fully.

But like any tool, you must understand how to use it skillfully and wisely to get maximum benefit with minimum risk. Which brings us to the 2nd question.

Creating Wealth is actually quite simple. Just follow these four rules: 1) Spend less; 2) Save more; 3) Invest wisely; 4) Give generously. In that order!!! The first 3 are the How’s. The 4th is the Why.

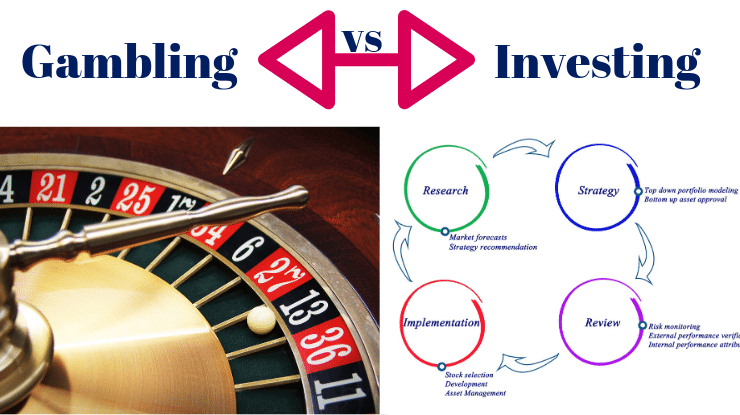

If it’s that simple, why is it so scary?Because the 3rd rule feels r-r-r-risky. But as Warren Buffet once said: “Risk comes from not knowing what you are doing.”

In other words: The biggest risk you take, in investing as in life, is making decisions based on fear, ignorance or habit…rather than knowledge (knowledge about investing AND yourself).

The more you understand the way investing works AND what makes you tick, the easier it is to separate from the herd, manage your emotions, and make informed investment decisions.

Now it’s your turn. Do you agree or disagree with my responses? Leave me a comment below.

Changing your mindset about Creating Wealth can be a challenge…but you don’t have to do it alone. Join my virtual community The Wealth Connection for the support you need to Become a Savvy & Confident Investor! Join today for only $47/month.