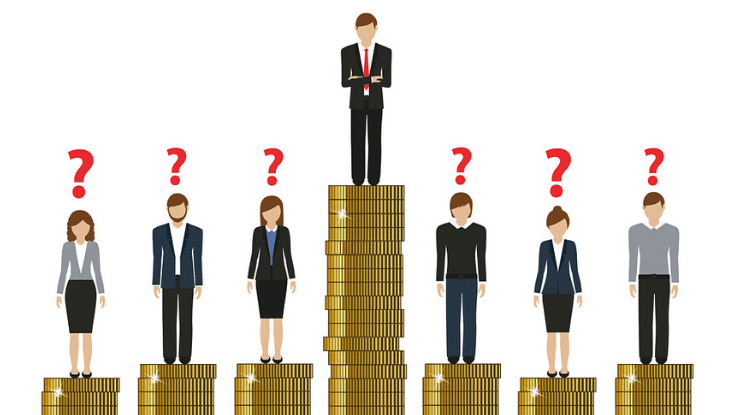

You say you want to make more money, right?

But understand this. Nothing will happen until you consciously decide to make financial success a pressing priority.

A decision is not the same as a goal. A goal denotes the desired destination. A decision implies the determination to reach it.

Here’s the beauty of a committed decision. You don’t need to have a plan all figured out. All you have to do is decide what you want and do what comes next.

Decisions are like magnets. They attract opportunities.

But be warned: those opportunities always lie outside your comfort zone.

You’ll come to a point where you must decide what you’re really committed to: increasing your income or staying where it’s safe.

You can’t have both. Have you done anything recently that’s outside your comfort zone? Leave me a comment below.

If you’ve made a decision to build your Wealth in 2020, I’m here to tell you it’s easier with support. Get the support you need to stay on the Wealth-Building path in my virtual community—The Wealth Connection. Learn More.

Give yourself the gift of community this holiday season. Join my virtual community The Wealth Connection. It’s the place for women to come together to become Savvy and Confident Investors and find support every step of the way!

Give yourself the gift of community this holiday season. Join my virtual community The Wealth Connection. It’s the place for women to come together to become Savvy and Confident Investors and find support every step of the way!

Give yourself the gift of community this holiday season. Join my virtual community The Wealth Connection. It’s the place for women to come together to become Savvy and Confident Investors and find support every step of the way!

Give yourself the gift of community this holiday season. Join my virtual community The Wealth Connection. It’s the place for women to come together to become Savvy and Confident Investors and find support every step of the way!