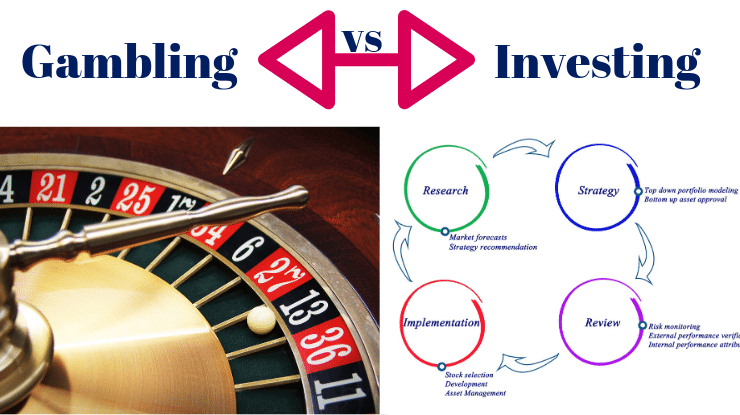

I’ve often heard people say: “Investing is no different that gambling.”

Au contraire. There is a big distinction between gambling and investing.

Gambling looks like this:

- Buying stocks or bonds willy-nilly

- Following a hot tip

- Purchasing the hottest fund

- Trying to time the market (buying when it’s high, freaking out and selling when it plunging)

- Deferring decisions to another and sticking your head in the sand

Investing, on the other hand, looks like this:

- Creating a financial plan based on your goals and risk tolerance

- Building a diversified portfolio, based on the plan

- Adhering to the plan until something changes

- Making decisions supported by your plan not your emotions

- Taking a long term approach (gambling is all about rapid gains)

Having a plan is the key distinction. If you don’t have an idea of where you want to end up, it will be far more difficult to make the right decisions.

Do you have a financial plan in place? Leave a comment below.

Did you miss my free call, The ReWIRE Response: Mind Training for Wealth & Well-Being? I shared 3 simple steps to train you mind to rewire your brain. Click here to listen