I spent most of my adult life in a financial fog as opaque as pea soup…and frustrating as hell. If you feel the same, you’re certainly not alone.

Millions of women today are stuck in a financial fog so thick and threatening, they can’t find their way to wealth and well-being. And the consequences can be devastating…on our self-esteem as well as our future security.

The way out of this miasma is not by learning more financial facts, but by first lifting the fog.

This fog is made up of a matrix of issues–suppressed emotions, limiting beliefs, childhood wounds stemming from cultural conditioning, parental messages, unhealed trauma and hidden shame.

When any of these issues are triggered, we feel threatened. Our logical rational brain shuts down, activating our primitive, lizard brain. We instinctively go into fight, flight or freeze mode.

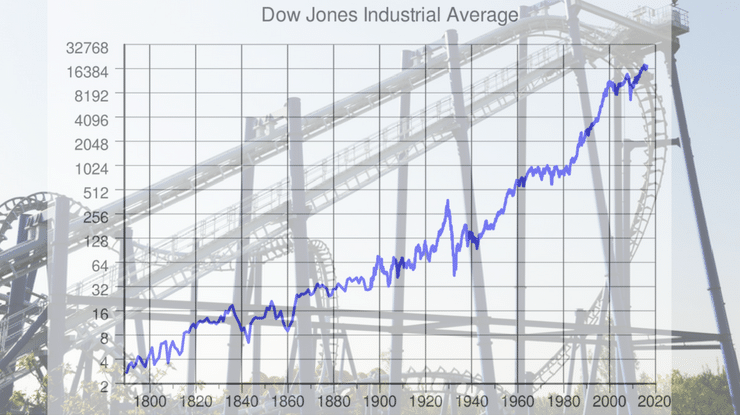

The result: we are unable to absorb practical information, reluctant to enter the market or deferring decisions to another, terrified of making mistakes.

Until we address our internal issues, allowing us to rewire our neuropathways, managing money will remain a struggle for even the best and brightest. I know this from my own experience and my work with thousands of women.

I’d love to hear your experience with lifting the fog by doing the inner work.

If you enjoyed this Words of Wealth, click here to receive a copy in your inbox every week.