Aspiring to wealth, these days, may feel like a ridiculous fantasy. After all, we’re in the middle of a recession caused by an unprecedented pandemic.

But consider this. Historically, after every downturn, there are always those who manage to prosper over a period of time. Why not you? The question is ‘how?’

I believe, Thomas Stanley, in his bestselling book, The Millionaire Next Door, gives us the answer: “Before you can become a millionaire, you must learn to think like one.”

Here’s what’s crucial to understand. You don’t need a huge salary or a stingy lifestyle to accumulate wealth.

I once read about a librarian who lived through the depression, made $8500 a year and left a $2.2m estate. And a 94-year-old bookkeeper, a victim of numerous recessions, who earned even less and was worth over $8 million at her death.

Both these women derived their wealth from carefully investing their earnings. Putting money in assets (like stocks, bonds, real estate) that grow faster than inflation, and holding tight despite the gyrating economy, is what creates wealth.

Yet a recent Fidelity survey shows that only 28% of women feel knowledgeable about investing. Even though a whopping 90% truly wanted to learn. What’s up with that?

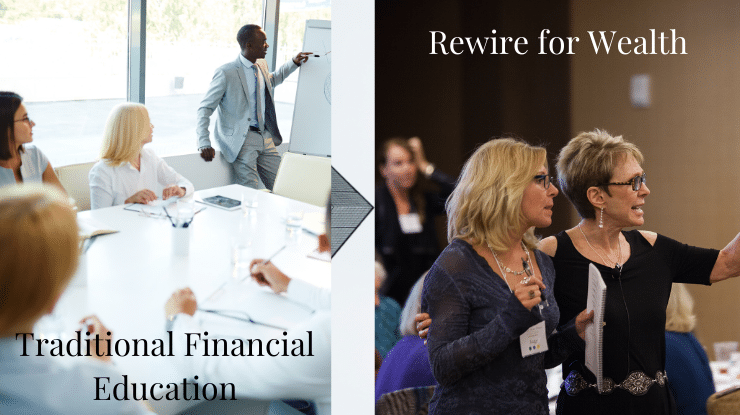

The problem, as I see it, is rooted in traditional financial education.

Pick up any money book or attend a financial class and the chances are it focuses exclusively on filling our heads with facts rather than fostering our courage to change or bolstering our confidence to act.

When’s the last time you read a financial article about overcoming internal resistance from a neuropathway programmed with false or limiting beliefs?

Which is why I wrote my latest book, Rewire for Wealth (available now) It’s also why I created my online community, The Wealth Connection (learn more here). And it’s why I want to help you build wealth, regardless of current events.

Because I know you can!

What is your experience with financial education that works for women? Leave me a comment below.

Comments & Feedback