Yes we’re in a pandemic. Yes, investing now may feel very risky. But understanding risk is what makes you wealthy. And so few people actually get it.

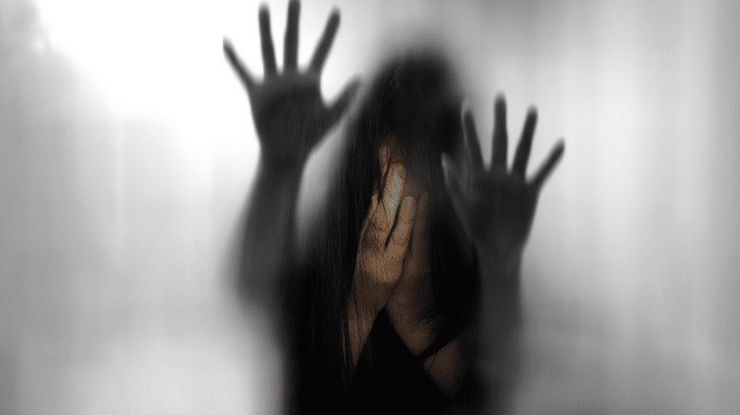

You want to know your most dangerous risk? It’s not the market’s gyrations. It’s your emotional reactions.

The emerging field of neurofinance has proven that most investors, regardless of gender, tend to act on emotions, not rational thinking, when making financial decisions.

The reason? Our brain registers risk even before we’re conscious of it. Consequently we tend to make rash decisions that rarely end well, even if we know better.

So when markets take a tumble, our emotions, especially fear, take over. And we make very bad decisions. It also happens in reverse.

When the market is on a big run, there’s a tendency to take on too much risk and follow the herd, like so many did during the tech and the real estate booms.

Either way, it’s easy to go along with the crowd and invest too aggressively during good times and too conservatively in bad times. Now that’s risky, in the most dangerous sense.

“The investor’s chief problem—and his worst enemy—is likely to be himself,” wrote Benjamin Graham in his timeless classic The Intelligent Investor. “In the end, how your investments behave is much less important than how you behave.”

I highly recommend that the next time the market drops, you do this immediately. Turn off the TV. Shut down the computer. Don’t look at your portfolio. Ignore the naysayers. Instead, take a walk or get a massage and remind yourself that the markets will go back up—because they always do.

If there’s one lesson I’ve learned, it is this: Making decisions based on fear, greed, or any emotion is never a good strategy.

What strategies do you use for investing wisely? Leave a comment below.

Comments & Feedback