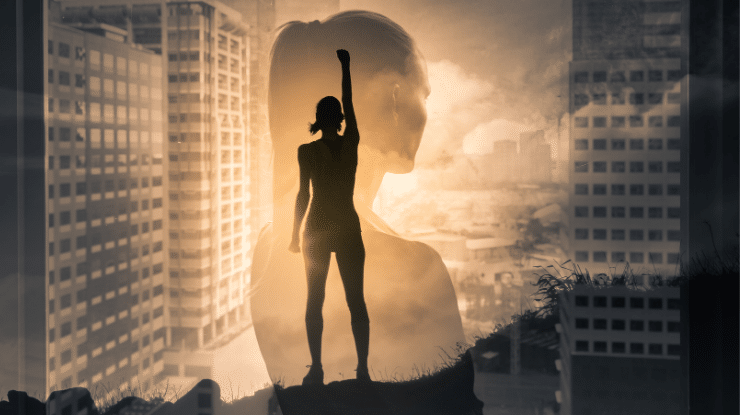

There is inside each of us a long-buried treasure—a deep-seated source of strength, daring, and focus—otherwise known as the Warrior Archetype.

This Archetype is the psychological blueprint for leadership and courage, for fierce determination in the face of endless obstacles.

I believe the Warrior Archetype provides the missing link in women’s evolution. The Warrior carries the hardwiring for our power.

Unfortunately, a lot of women shun this Archetype. They equate Warrior energy with cruelty, destruction and violence.