Years ago, I trusted my husband with my money. He was a stockbroker after all. But, alas, he lost almost everything. After our divorce, I was terrified to trust anyone again.

Then at some point it dawned on me. I couldn’t just ignore money. I needed to start trusting myself. But how? I was financially clueless.

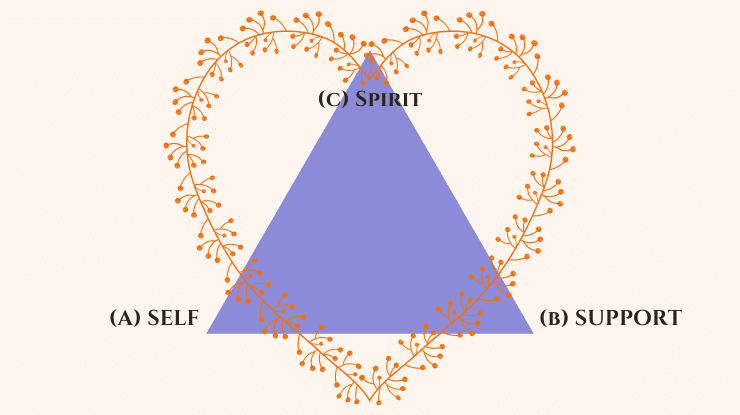

If you’re in a similar situation, let me introduce you to what I’ve come to call the Trinity of Trust. It’s how I began the journey of reclaiming my power and taking financial responsibility

As I spent time connecting with each point on this triangle, I found myself building a firm foundation of trust in myself, in others who were trustworthy, and in the my Higher Power.