Ask a novice investor to define risk, and most will say losing money. They look at market fluctuations and all they see is the likelihood of loss.

An educated investor, however, looks at those same market fluctuations and sees opportunity for gain.

The truth is, our biggest financial risk is not market volatility. Our biggest risk is to do nothing at all.

Sure the market’s ups and downs are scary. But you can dramatically cut your losses with due diligence, a long term approach, and good diversification.

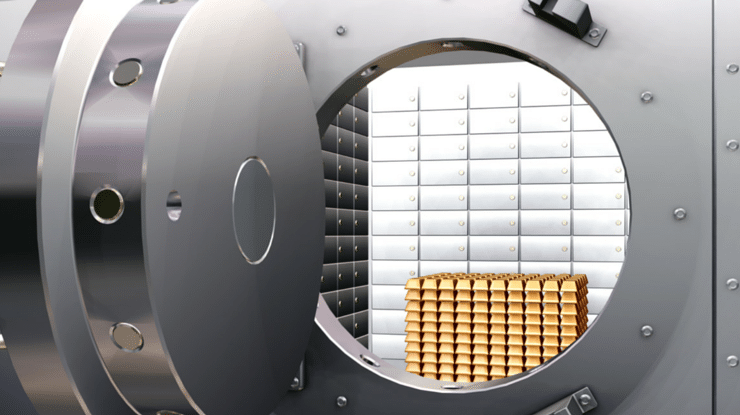

On the other hand, if all your cash is sitting in the bank, your purchasing power will shrink like a wool sweater in a hot dryer.

At least a portion of your savings needs to be in assets that grow faster than inflation and taxes eat it away.

Otherwise your greatest risk, as a woman, is that you’ll outlive your money.

Wall Street Journal intimidate you. It’s a fabulous learning tool…and offers some fascinating reading… for everyone, no matter how much, or how little, you know.

Wall Street Journal intimidate you. It’s a fabulous learning tool…and offers some fascinating reading… for everyone, no matter how much, or how little, you know.